Hey guys, Merck back with another quick video. I just want to do a quick one today about taxes since it is tax season. In the beginning of February last year, it was the first year I ever flipped a house. Basically, I bought a house at a tax auction for a very cheap price. Not many other people were interested in it. I was planning to fix it up and do a write-off thing with a friend of mine. It was a huge house and there was a lot of work involved. Eventually, we decided to go ahead and flip it. This year is the first year that I learned about the tax implications. Right away, I told my friend that the house went cheap, it was sold for $8500. He said, "Anything under $10,000, don't worry about it." That's not true. Anything over $600, you're supposed to report it to the IRS. If you close the house by yourself, you have to do it yourself and fill out the 1099s. If you have a closing agent, they should provide it for you. I think you're supposed to have it by the first week of February of the upcoming year for taxes. For me, I sold the house in 2016, so I had the 1099s from my agent last week. It's the beginning of February 2017 now. Basically, you get the form and it states that I closed the house for $8500. Obviously, I didn't make any $500, am I right? So this is what you have to do for your taxes, because the IRS always assumes the worst, that you've made all the money that you got, which is never true. If you don't take care of your stuff, they're going to come after you for the whole amount. You...

Award-winning PDF software

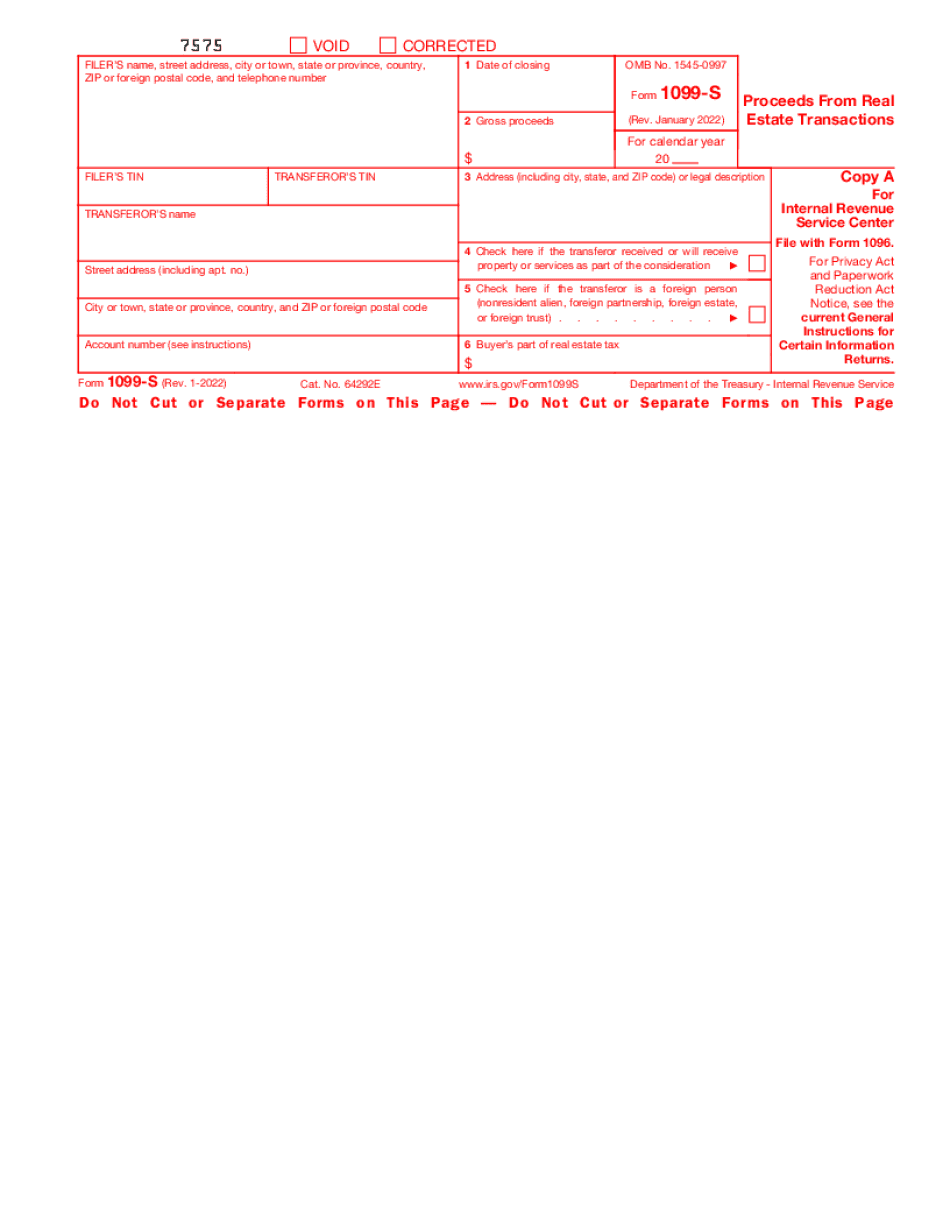

What is 1099-S Form: What You Should Know

Form 1099-S: Don't Sell It! Don't Reality Check: 1099-Mortgage and Other Business Expenses Form 1099-MORTGAGE is used by home sellers to report mortgage interest paid, property taxes and maintenance. When Form 1099-Mortgage & More Expenses Why is Form 1099-MORTGAGE Important? When a home buyer is considering a purchase of a new home, an important consideration is that the Property Tax Deduction Can Be a Real Catch 22 For a home buyer trying to find ways to reduce a property tax bill, the form 1099-MORTGAGE for business expenses may Be The Biggest Mistake in the Home Buying Process Real Life 1099 Tips: · Keep it short and sweet (1 page!) · Make sure and print it at least 20 days before the property was bought to allow for any · Record payments on time with a timely payment stamp. · If you receive a Form 1099-Mortgage, make sure all payments made by the same person are recorded.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-S, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-S online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-S by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-S from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What is Form 1099-S