All right, welcome everybody! My name is Doug, and this is a webinar hosted by Steiner Business Solutions. We are here to guide you on how to fill out 1099 forms. I will explain what they are for, who has to file them, and who doesn't. Additionally, we will discuss how you can file them through QuickBooks. There is a list of structural information and basic general knowledge about 1099 forms. Moreover, I will also discuss the benefits of using QuickBooks for filing. You can easily print the forms through QuickBooks if you are already doing the bookkeeping in the software. Let's pull up a 1099 form to see it in detail. The purpose of a 1099 form is for companies to report the payments they have made to subcontractors, individuals, or other companies that provided subcontracted services. This form serves as a double-check for the IRS to ensure that companies are accurately reporting their income. It is similar to the W-2 form used for reporting employee income. Subcontractors can use the 1099 forms to prepare their own personal tax returns. Copies of these forms are also sent to the IRS, so they are aware of the payments made to subcontractors. Here are the rules for qualifying for a 1099 form: - If you paid your vendors at least $10 in royalties or broker payments instead of dividends or tax-exempt interest. - If you paid your vendors at least $600 in rents. - If you paid for services provided by someone who is not an employee (this could be a business or an individual). - If you made payments for prizes and awards. - If you made other income payments, such as medical and healthcare payments, crop insurance proceeds, cash payments or fish, and payments to an attorney. Now, let's discuss some exclusions to these examples. Generally, payments...

Award-winning PDF software

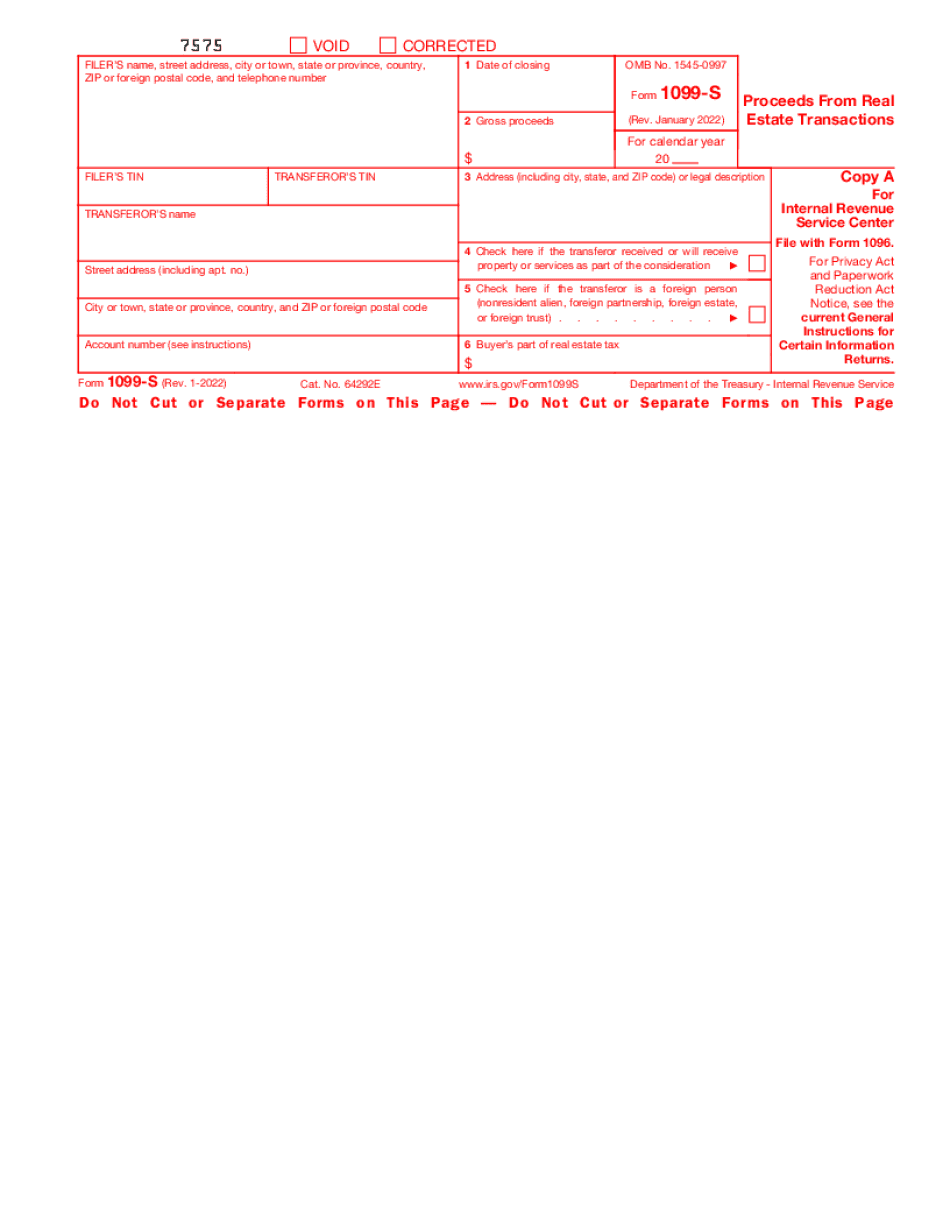

How to fill 1099-S Form: What You Should Know

Reporting Form 1099-S because of the exchange of primary residence, then you'll report the exchange on Filing and Paying Your Tax Your 1099-C, 1099-S, or 1099-MIS may need to be amended because of the event reported under Item 5, Property, where.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-S, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-S online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-S by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-S from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How to fill Form 1099-S