Good afternoon my name is Ryan fields and I'm a trust in a state's attorney with the Kings prior law firm in Bethlehem Pennsylvania thank you for joining us as King spry and gray friars Institute present don't sell the farm unless you want to inheritance tax exemptions for family farms now before we get started today I just want to address a housekeeping issue please note viewing today's web webinar does not create an attorney-client relationship nor does the content of this webinar constitute legal advice the materials for this webinar were created solely for informational purposes and may not be shared or reproduced without the express written consent from Kings Bry Herman Freund and fall LLC additional information about our practice programs and services can be found on our website at wwlp.com okay so before we get started let's look at what will be discussed during today's presentation to start we will talk about life and planning before the exemptions the inheritance tax exemptions brought on by act 85 to be sure prior to the exemptions there were various creative ways to try and pass on farming and agricultural property to the next generation we'll look at some of those methods and how if at all some of those methods may have changed since the exemptions took hold next we'll look at the actual language of act 85 of 2025 as well as act 84 of 2025 which modified some of the language allowing for the exemption of farmland from inheritance taxes the two sections which were added by act 85 are not lengthy but there is a lot of language to digest we'll also look at the family business exemption which took effect in 2025 and how that interacts with the farmland exemptions finally we'll do some...

Award-winning PDF software

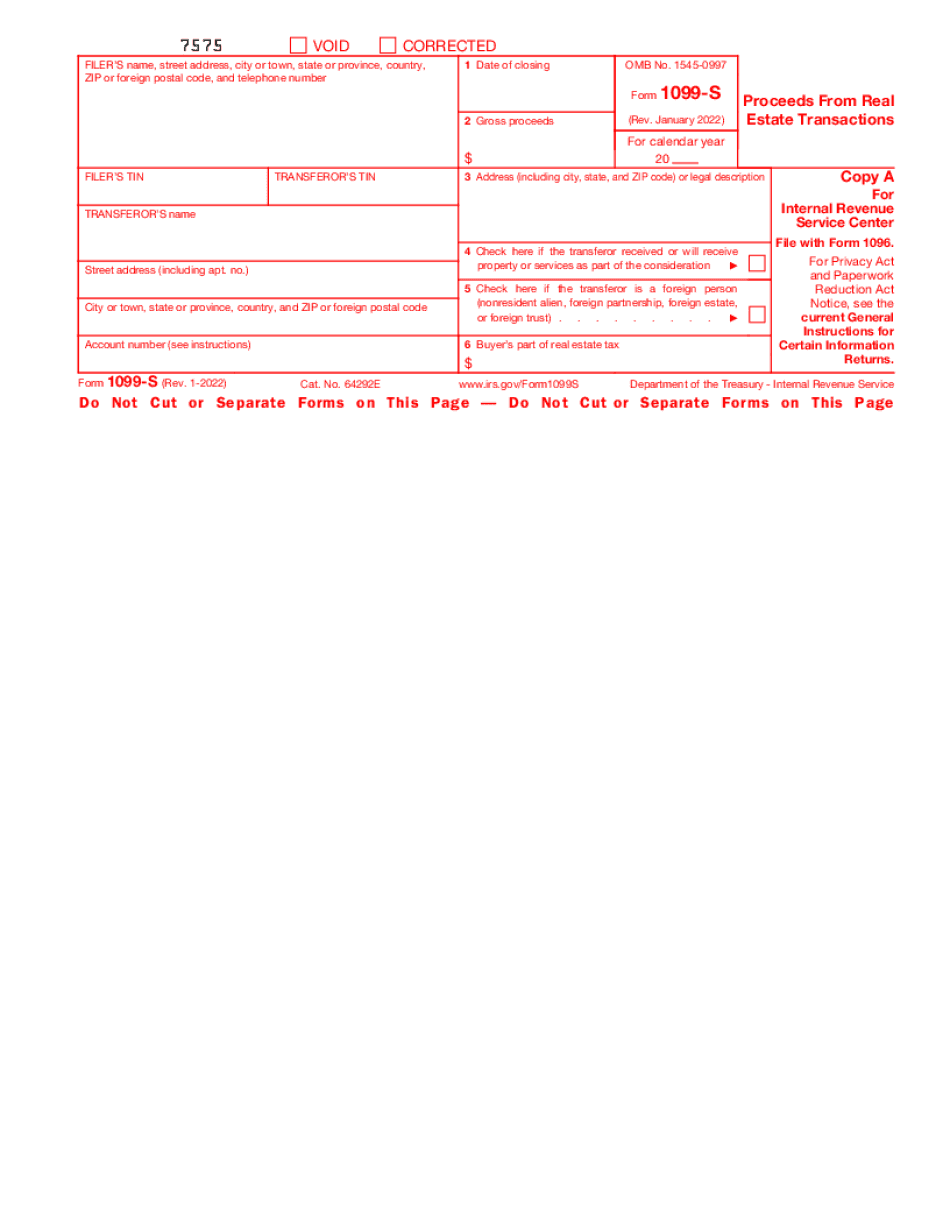

1099-s inherited property Form: What You Should Know

Who is required to file Form 1099-S? — The Executor or Administrator. Form 1099-S, Proceeds from Real Estate Transactions, to report the sale or exchange of real estate. Reportable Real Estate. Generally, you are required to file Form 1099-S, Proceeds from Real Estate Transactions, to report the sale or exchange of real estate. The sales Who is required to receive Form 1099-S? — All heirs. Is the sale of real estate taxable? — Yes. What if the buyer is a corporation? — It is taxable to the recipient of the proceeds, but the company must file its own 1099-K (instead of paying the estate). Question on 1099-S. Corporation Form 1099-S — TurboT ax Ax Support A corporation must file Form 1099-S if all or a portion of the consideration for the disposition includes the consideration for the transaction, regardless of where the consideration is received. The company and any of its affiliates must also report the proceeds to which it is entitled as part of the corporation's income, regardless of where the proceeds are received. Therefore, a corporation that receives a portion of the consideration and the proceeds from its sale of real estate would not include the proceeds in its income. Form 1099-S, Proceeds from a Sales Transaction, to report the proceeds from the sale of real property. Reportable Real Estate. Generally, you are required to file Form 1099-S, Proceeds from Real Estate Transactions, to report the sale or exchange of real property. The sales Who is required to file Form 1099-S? — The Executor or Administrator. Is the sale of real estate taxable? — Yes. What if the buyer is a corporation? — It is taxable to the recipient of the proceeds, but the company must file its own 1099-K (instead of paying the estate). Answer: No. Who is required to receive Form 1099-S? — The Executor or Administrator. Is the sale of real estate taxable? — Yes. What if the buyer is a corporation? — It is taxable to the recipient of the proceeds, but the company must file its own 1099-K (instead of paying the estate). Question on Form 1099-S — Tax-Free Asset Transfer. Transfer of Money. — No. Question on Form 1099-S — Transfer of Money.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-S, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-S online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-S by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-S from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1099-s inherited property