Welcome to the 1099 form instruction course. I'm so glad that you decided to join us today. Just a quick bit about me, I've been an enrolled agent for quite a few years now and have been in the tax practice for about 25 years. The fun thing is I get to share my knowledge with you. Today, we will be discussing 1099s and providing more instruction on them. We may think it's easy, but hopefully, you'll learn something new by the end of this course. This is a three-part course, and in part one, we will talk about when, how, and where to file, as well as some technicalities. Part two will cover all the details about the 1099 forms and their instructions, and in part three, we'll provide additional information you need to know. So, in this course part one, we'll start with a general overview of 1099 reporting, why we have to do it, when to file, and recent changes to the due dates. We'll also discuss how to file, where to file, who should receive a 1099, and any exceptions that exist. Stick with us for the next hour, and we'll help you learn something new. Now, let's dive into the general overview of 1099s. First of all, there is a tremendous amount of misunderstanding when it comes to the requirements related to 1099 forms, especially regarding independent contractors. In the past several years, there have been various new requirements and legislation put into effect and then removed, causing confusion for individuals, businesses, and organizations. This constant change makes it difficult for everyone to keep up. That's why we've put this information together, to help you understand what is required. This is just a quick summary of the three parts we'll be covering. It will provide...

Award-winning PDF software

1099-s reporting 2019-2025 Form: What You Should Know

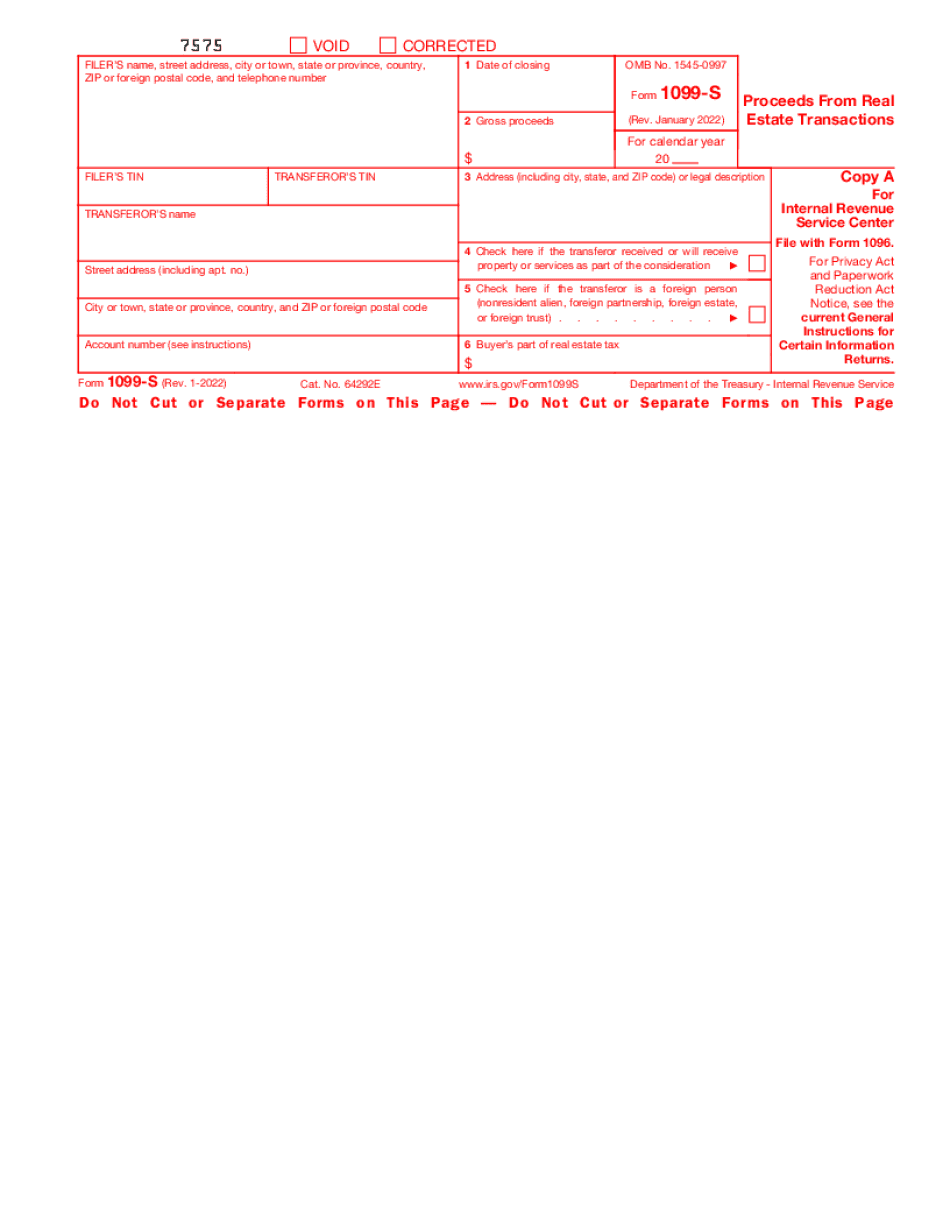

Form 1099-S. (Rev. March 2012), (IRS). See Also 1099-S Forms — How to Get Them and How to Report Them Schedule C — Miscellaneous Deductions Schedule D — Foreign Bank and Financial Accounts Schedule E, Taxable Capital Gains and Losses — Qualifier and Exclusion for Real Estate Investment Properties Schedule F, Taxable Capital Gains and Losses — Qualifier and Exclusion for Nonresident Alien Businesses Form 8949, Statement of Treatment, Exiting the U.S. for Foreign Business, is used by the Internal Revenue Service to report the disposition of U.S. real estate by a nonresident alien and an estate with interests in U.S. real estate. Foreign Financial Accounts Report Required for Overseas Interest in U.S. Real Estate (Information for New Reporting Requirements) by Solo .com Form 8283 — Foreign Bank and Financial Accounts Foreign Interest Deduction by Nolo.com Form 8978, Foreign Bank and Financial Accounts Foreign Accounts, is used by the Internal Revenue Service to account for income and expenses that can be included in a gross income return to the United States. Form 8978 — Foreign Bank and Financial Accounts Form 8938 — Exemptions for U.S. Businesses (Form 943) Foreign Funds from U.S. Income Tax by Solo .com Forms 1099 and W-2G (in PDF Form) and W-2B (in PDF Form). These are the IRS forms available for use on the Internet. Related Tax Topics Form 1040 E-file (if filing on paper) or on-line (if filing electronically on Schedule C or Schedule E) Form 1040EZ (if filing on paper) or on-line (if filing electronically on Schedule C or Schedule E). Form 1040 (download the PDF) Form 1040-EZ (download the PDF). Form 1040NR (download the PDF or view in Acrobat Reader) Form 1040A (download the PDF). Form 8848, Statement of Receipt, etc.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-S, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-S online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-S by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-S from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1099-s reporting form 2019-2025