Hello friends, Amanda here from the Business Finance Coach. Welcome to my YouTube channel. In this video, I'm going to be answering another question from a graphic designer and discussing income for taxes when you're self-employed and providing services online. Alright, so the question is, "I did work for a company, but some of the money they paid me was through the wife's personal account, and some was through the payroll system, some was through the parent company's payroll system. I didn't know about this until I asked her about the 1099. So now, I have to list them as separate income sources, is that correct?" Great question! It is a great question and it makes sense why someone would ask that question, right? Because when you work for a company, you report a W-2. Well, when you work for yourself, it's a little bit different. If you think about it in terms of a store, like a convenience store, all the people that come in don't report income for every person that comes into the store. They report their total sales. Well, when you're self-employed, I know it might not seem like it because you didn't go out and start a store, maybe you didn't even intend on starting a business. But to provide your services, you end up being self-employed. So when you report sales, you report sales in the same way. Your total income is your total sales. Sometimes people will say to me, "Well, I didn't get a 1099. What do I do? Do I report it?" Well, yeah, you're supposed to be reporting all of your sales. Everything everyone pays you, you're supposed to report it. Now, this is a great question because it does get a little tricky with the 1099. Our government is interesting because what they...

Award-winning PDF software

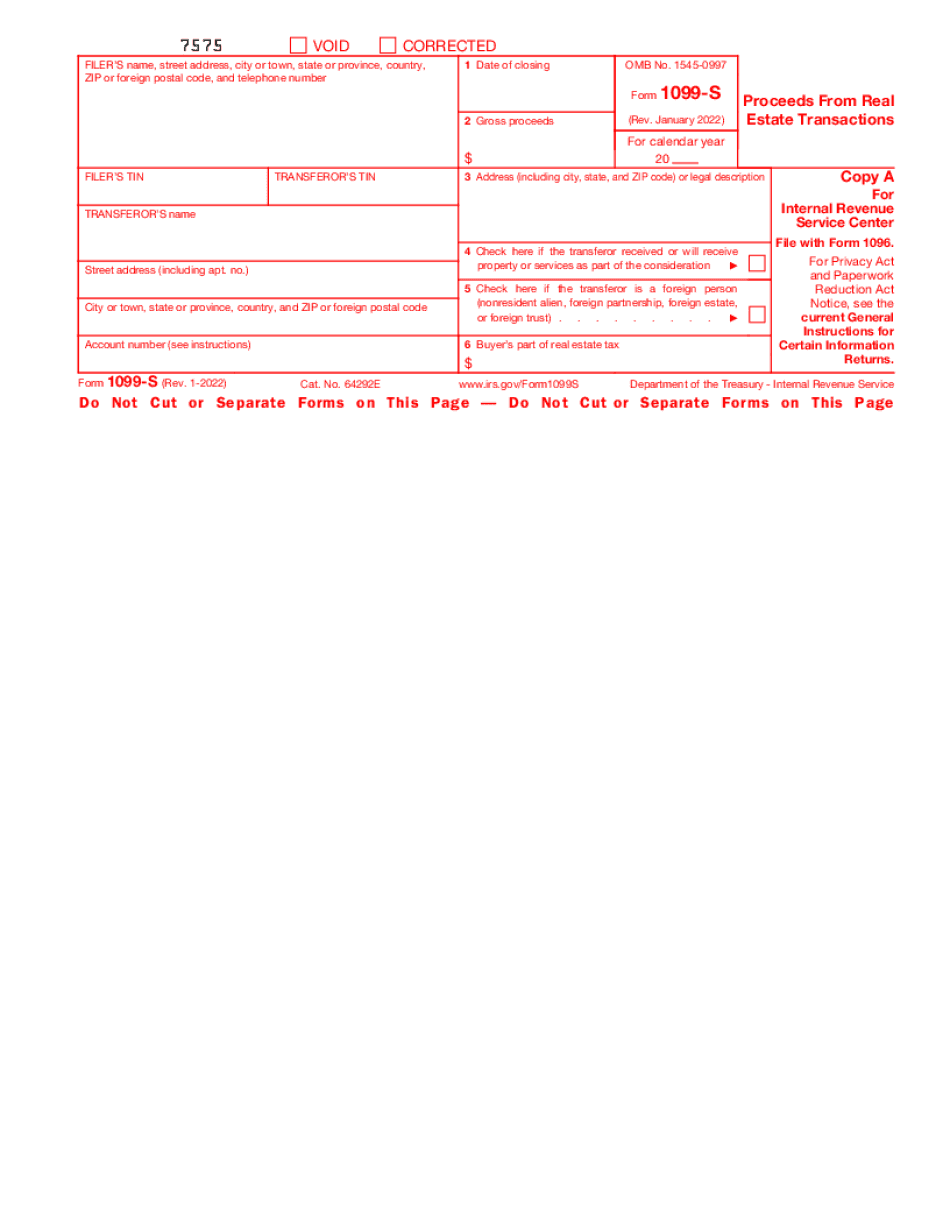

1099-s reporting 2019-2025 Form: What You Should Know

Form 1099-S helps you meet the deadline for filing your 1099-S tax return. The Form 1099-S is an electronic document filed by the person or business using the proceeds from the real estate transaction (the “real” real estate). It also includes information about the following, including the use of the real property with an interest in the transaction. Deducts for property used for personal, investment, or business use. Interests on the real estate transactions. The total cash proceeds of property sold (including the cost basis for that property) over the 10-year period. How much interest you received on your investments in real estate. How to report a sale by a nonprofit organization or charity. Report the proceeds from your real estate sale on Form 1040, U.S. Income Tax Return. 1099-S — Proceeds From Real Estate Transactions (U.S. tax form) Filing information on real estate sales or any other noncash income is a major tax consideration for taxpayers. As such, it is critical that each taxpayer understand the requirements surrounding the sale of property. The IRS is committed to facilitating the return of tax on sales of property through the use of the noncash transactions reporting regulations in the Internal Revenue Code. By providing guidance on the Form 1099-S filing process, the IRS will make it easier for taxpayers to comply with the requirements for reporting income on sales of property. Form 1099-S (Real Estate) — Taxpayer Identification Number. Required information: Name and address and date of birth Number on the line beginning with “Y” Employer Identification Number 1099 form: IRS 1099 form. (1) If you sell, change in ownership, assign, or change a title to real property, the following information is also required: (2) The buyer's name, address, and the seller's identification number. (3) Date of sale. (4) Selling price. (5) A statement that the buyer used the property only for investment or for personal, business, or charitable use. (6) Identification of the owner of the real property, if different from the seller. (7) If the real property was a joint venture, a description of the operations and income statements. (8) A statement specifying whether any proceeds, other than proceeds from sales of commodities, went to the partnership. (9) A statement that you are selling the real property.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-S, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-S online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-S by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-S from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1099-s reporting form 2019-2025