Award-winning PDF software

Basis of inherited property in a trust Form: What You Should Know

The step-up in basis applies to certain kinds of property including: (1) Certain types of life insurance policies, life estates, life savings plans, and other investments for which Congress has set a dollar limit; (2) Certain life estates, but not other investments; (3) Certain estates, but not other investments; (4) Specified pension plans, unless a federal or state law prohibits the participation of a step-up beneficiary in such a plan. The following types of investment assets qualify for the step-up basis exemption: Inherited property is not included in this list, as Step-Up in Basis Benefits are available to all beneficiaries of a decedent. Beneficiary's Determining Costs is different for each type of asset. When a beneficiary determines the costs associated with an asset during the life of the decedent, the cost of the asset is calculated. Each asset has its own cost basis. The costs of an asset that a beneficiary owns up to death are taxable at that asset's cost basis; the costs of an asset that a beneficiary owns up to the time of a trustee's appointment or at the time the decedent's assets are transferred to another beneficiary are exempt from taxes and the gains are reported on Form 706 (or a successor form); and the costs of an asset after a beneficiary's death are considered a gift to be reported on Form 1099-G (or a successor form) (or, in some cases, Form 888). Beneficiary's Determining Amount of Basis — How to Do It. The cost of an asset is the difference between the cost basis and the tax exemption amount for the asset. To determine the cost basis for a specific asset, the beneficiary calculates the tax exemption, then subtracts the cost basis from that exemption amount. The tax exemption amount is a fixed dollar amount that, in general, is indexed annually; it is not subject to inflation. To determine the cost basis for a specific asset, calculate the tax exemption, then subtract the cost basis from that exemption amount. Beneficiary's Determining Costs on the Assets in His or her Estate. Because each specific asset has its own tax basis, a beneficiary's costs should be calculated for each individual asset for which he or she is responsible. A beneficiary's costs on the whole estate may include the cost of all the assets in the particular estate.

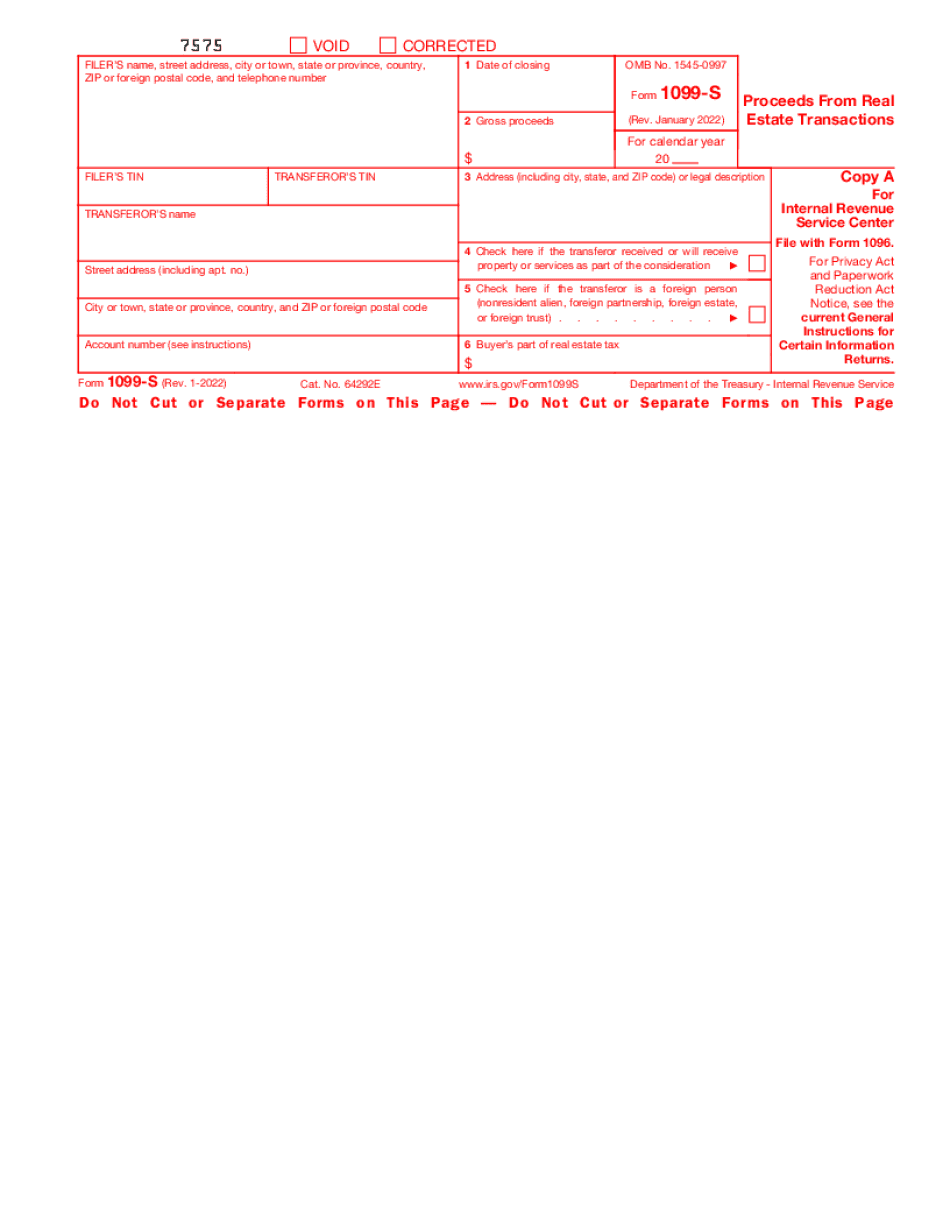

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-S, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-S online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-S by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-S from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.