Award-winning PDF software

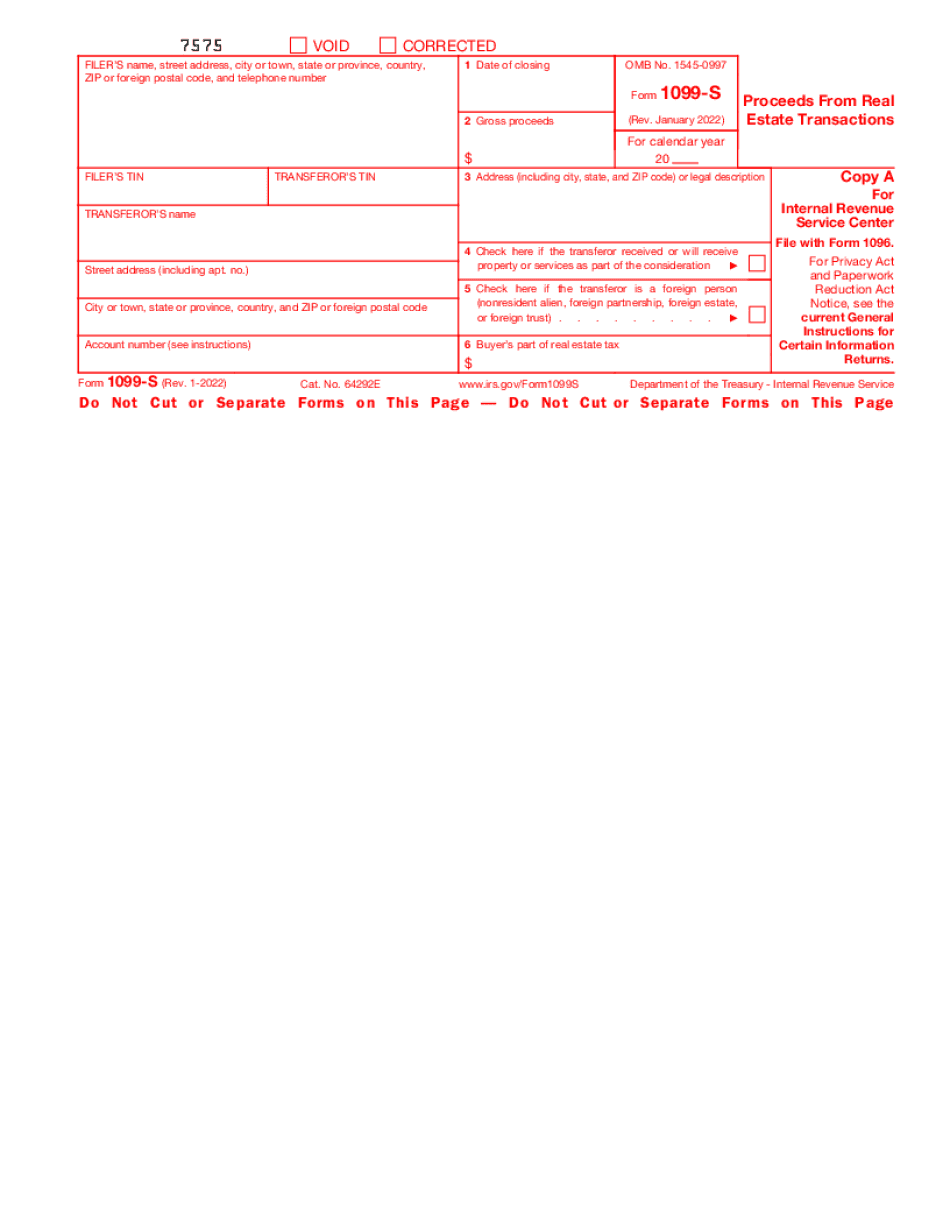

Form 1099-S for Stamford Connecticut: What You Should Know

Elderly / Disabled Homeowner Tax Relief Programs Section 4 of the Stamford City Code 1282 provides special relief for homebuyers and current homeowners of senior citizens and disabled persons who, because of age or disability, are unable to manage such purchases within the time required by Connecticut law. This ordinance allows current homeowners of senior citizens and disabled persons to deduct 25% of the purchase price for qualifying residential purchases during the tax year 2017. All other homeowners will not be allowed to claim the deduction on their New-Home Mortgage Interest income tax return (Form W-2). Qualified homeowners will have the deduction applied to only the annual interest and late payment payments charged for purchases in the tax year 2025 under Section 8 of the City of Stamford Homebuyers Tax Relief Act of 2025 (see City of Stamford Special Residential Mortgage Prepayment Relief Act of 2025 — Form 7). Homeowners who pay off existing home purchases without incurring late or late payment charges will not be eligible for the deduction. The exemption allowed under this ordinance does not apply to sales of homes with a price limit of 10,000,000 or more, which is defined as the sum of the assessed value of all real properties in the city at the beginning of the tax year 2025 multiplied by the ratio of the city's 2025 taxable assessed value (computed as the market value of all properties in the city as of the date of the tax year) to the total city taxable valuation as of the beginning of the tax year 2017, as established under the “Total Property Tax Valuation Ordinance” adopted by the City Council of the City of Stamford in December 2025 and which is indexed for inflation and subject to adjustment on a quarterly basis. In addition, to qualify for the deduction, homeowners must be U.S. citizens and residents of Connecticut. For more information see: Housing Section 10(11) of the Charter to which the residents and business of the City of Stamford are entitled by virtue of section 40(13) of the Charter to make all decisions which the City Council may, by ordinance, make at any general, special, or local meeting of the general assembly pertaining to the city and to make all other rules and regulations to carry out the objects and purposes of the Charter of the City, is incorporated as a new section 40(1) by this statute.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1099-S for Stamford Connecticut, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1099-S for Stamford Connecticut?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1099-S for Stamford Connecticut aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1099-S for Stamford Connecticut from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.