Award-winning PDF software

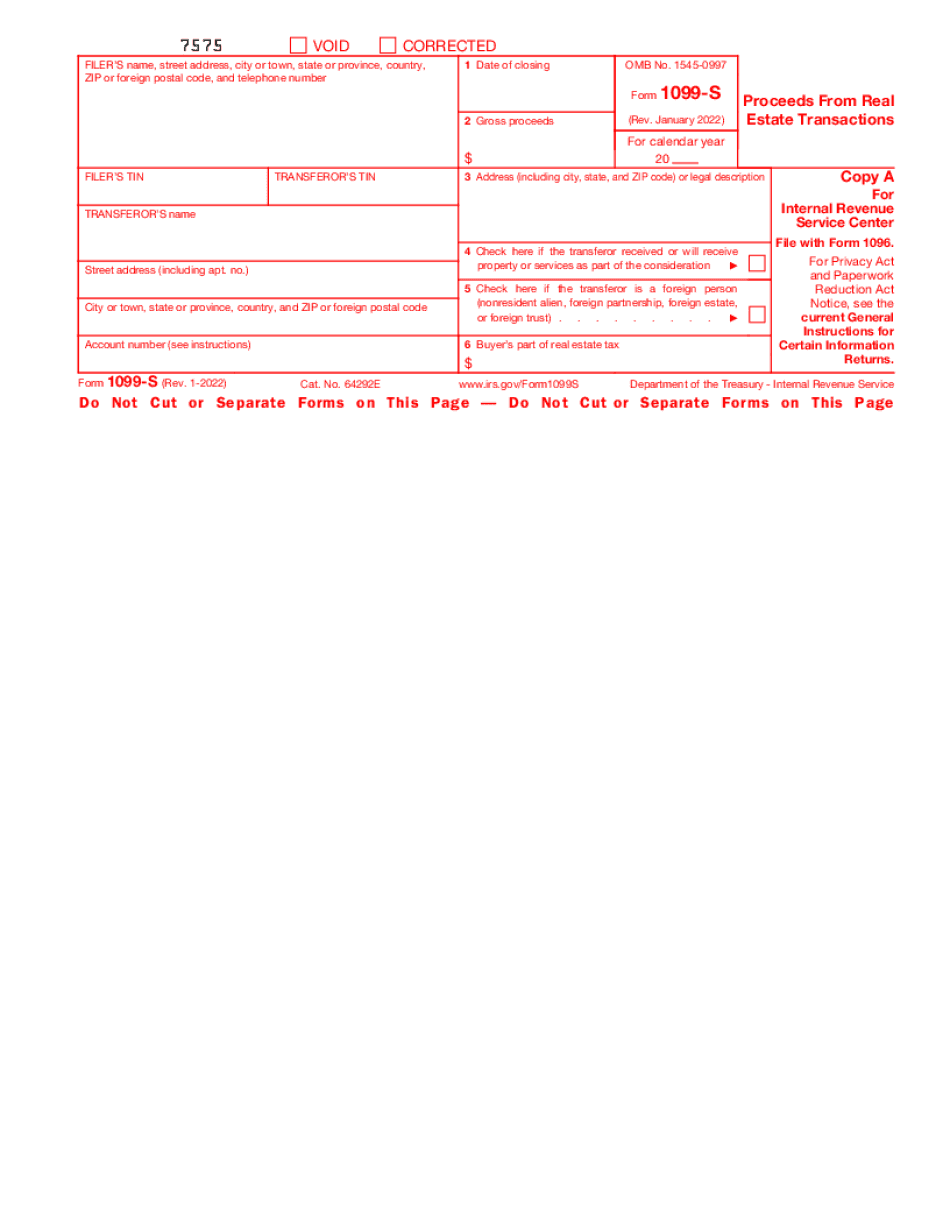

Form 1099-S online Bellevue Washington: What You Should Know

The 1099 must be accompanied by the original or certified copies of any tax-sheltered certificates in your possession. The 1099 can be made available to a third party so long as it has to do with your own personal financial transactions. This is a tax-exempt document and as such, can be filed without a person's consent. What does it mean to have an S-Corp? In most states, an S-Corp (sometimes referred to as an LLC) is a business organization that is operated for the benefit of another person or group of people, and in which the members also have no real and substantial equity interest. This designation as an S-Corp allows the S-Corp to operate a more flexible tax system than an LLC. The S-Corp is also treated as having the same liability limits as a domestic corporation. S-Corporations are taxed on their owners' individual income, with the money they generate going to a non-profit, such as a church, sports team, school, or museum. If you form your corporation based on personal savings and then distribute all the profits to your church, school, or museum, you would receive a 25% federal tax deduction. There are three criteria an S-Corp needs to meet to register as an S-Corp in the state of Washington; 1. The business must be operated for the benefit of more than one person. If an S-Corporation is formed by the sole proprietor of a one-person business who uses the income directly for business or personal purposes, then the business does not meet the first requirement. 2. Shareholders of the corporation must share in profits at least 25%. The S-Corp owner must use the S-Corp profits for business. 3. The corporation must be organized as a social welfare organization. The S-Corp income tax is calculated on profits. You can deduct the tax you pay to the S-Corp on the first 30,000 in taxable profit for an S-Corp (the owner must not be liable for the tax on the excess profits). The S-Corp tax does not apply to any profit on which section 117 or any other state income tax has been abated as of the first day of the taxable year. 1099 form is not tax-sheltered document; it is only a proof of income and a form you will need to file.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1099-S online Bellevue Washington, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1099-S online Bellevue Washington?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1099-S online Bellevue Washington aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1099-S online Bellevue Washington from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.