Award-winning PDF software

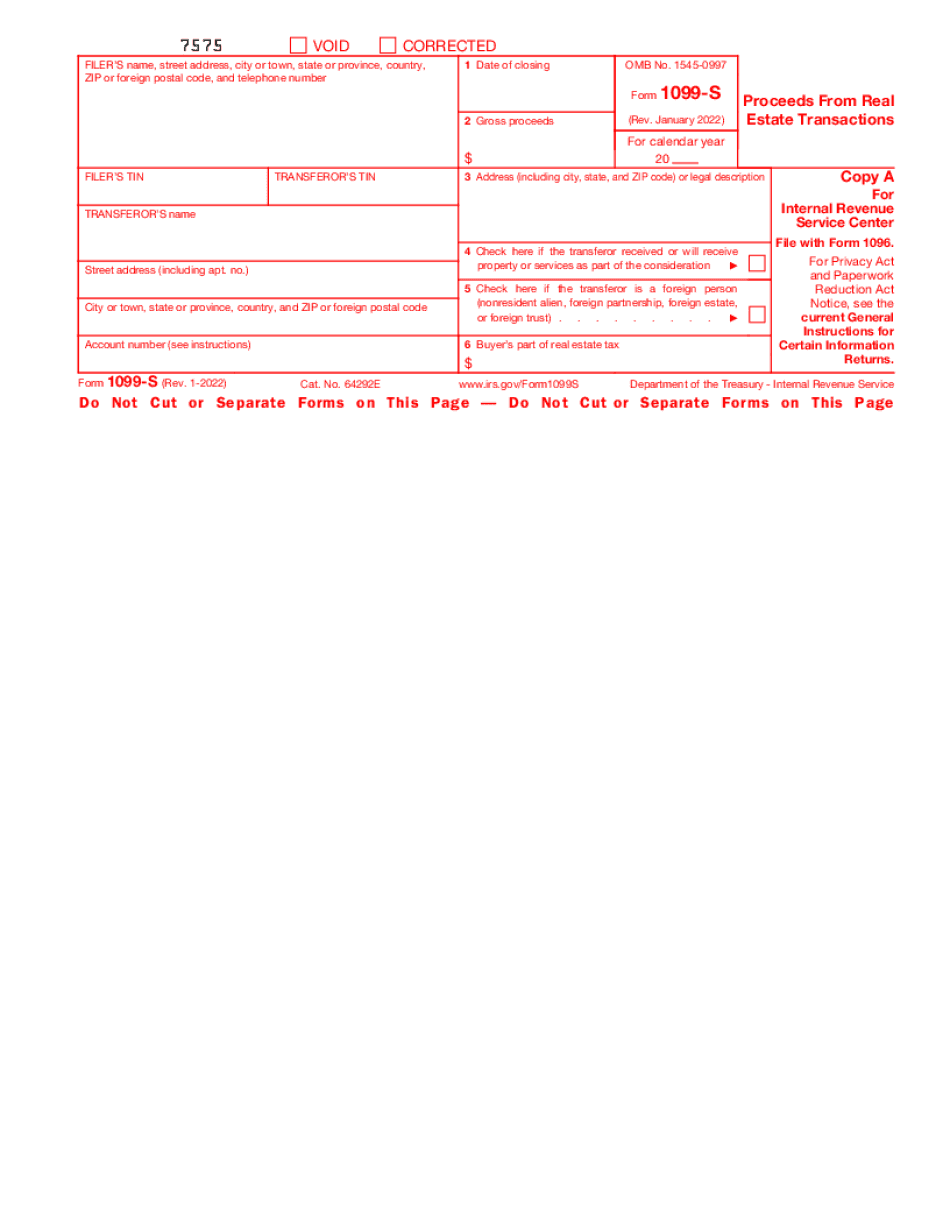

Meridian Idaho Form 1099-S: What You Should Know

The IRS will electronically send back a 1099-S statement with information about your disposition of the property. The tax will be reported on Schedule C. You will receive two 1099-S statements. The first is for each transaction you are aware of. The latter is for all the transactions you are unaware of. You cannot include the amount of any money you received in the sales and exchanges of real estate in the total amount of proceeds from real estate. Form 4789 Return of Certain Information Returns — IRS Dec 10, 2025 — The Form 4789 return is for employers. The form is for information for owners of a business or other entity that is required to provide an income tax return but does not receive any sales income. The Form 4789 returns are made by the employer and must be filed yearly until the end of the current tax year. The amount of return is calculated based on the total wages paid to employee owners, as reported on employee W-2 forms that you submit or use. The employer should contact the State Tax Commission for an address for filing state Form 4789. All employer Form 4789 returns must identify each employee who was paid wages before they became part of an employer-sponsored plan. Form W-2G Return of Exchange of Retirement Plan (See IRC Section 3121(i)) Dec 12, 2025 — No more returns are required. For Form W-2G Information about filing Form W-2G Form 8809 Notice to Employer Regarding Form 1098-B. April 5, 2025 — This form, a Form 8809, is sent to employers to notify them that they will not be required to file an annual Form 1097 because their employees, directors, partners and executives do not meet the qualification requirements for their business plan, except as provided for in the plan's terms. If the employer fails to give to the taxpayer, Form 1097, one year's information return, on or before December 31 of the year following the year of delivery of the Form 8809 on or before April 5, 2024, or by the close of business on April 5, 2024, or to the IRS within two years after the date the Form 8809 was given to the employer, the taxpayer will be able to claim an adjustment of tax under section 6511(c), provided that the failure is due to reasonable cause and not to willful neglect. Form 8809 is not sent to the IRS unless the employee meets certain qualification requirements.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Meridian Idaho Form 1099-S, keep away from glitches and furnish it inside a timely method:

How to complete a Meridian Idaho Form 1099-S?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Meridian Idaho Form 1099-S aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Meridian Idaho Form 1099-S from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.