Award-winning PDF software

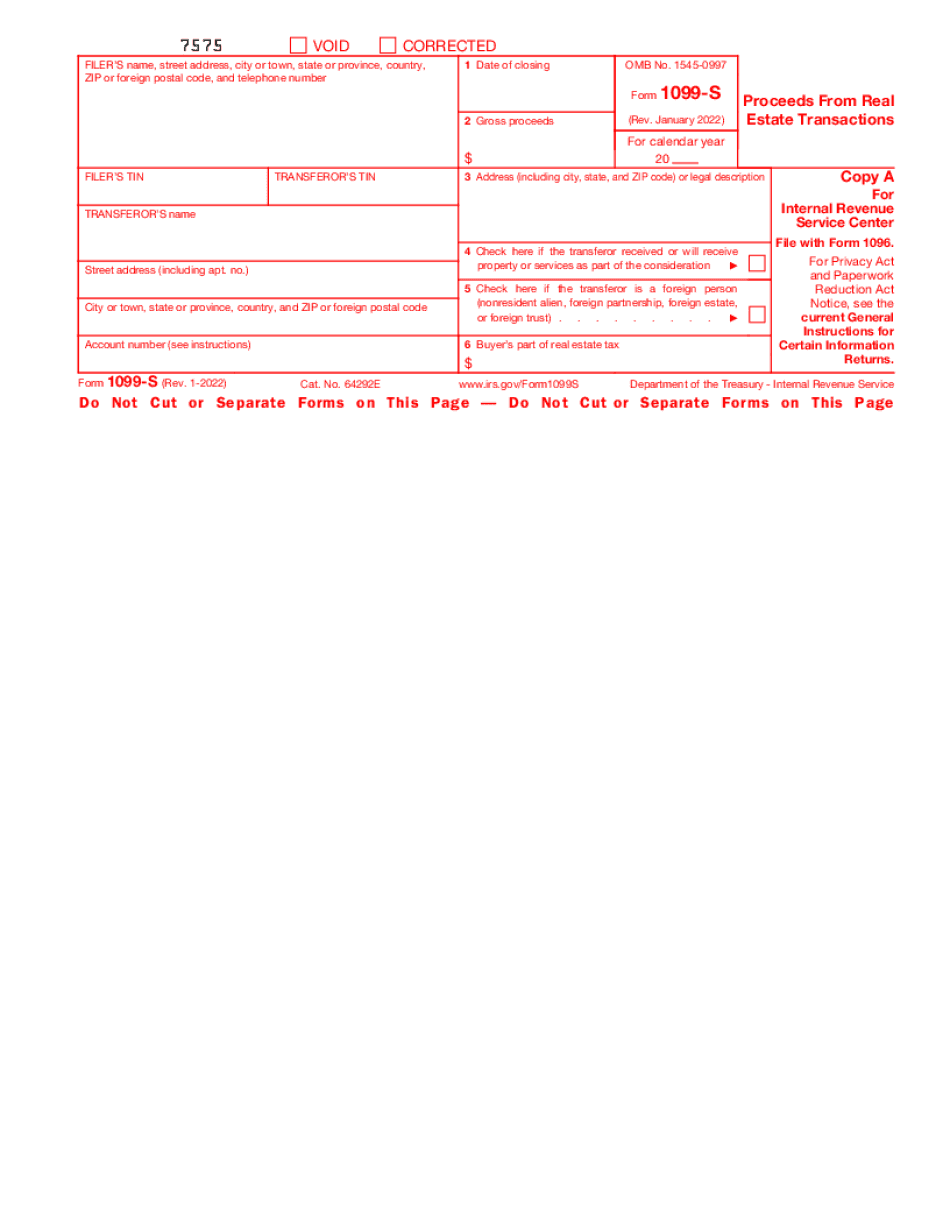

Printable Form 1099-S High Point North Carolina: What You Should Know

This site is not a recommendation or endorsement of any company, service or company name. It contains some affiliate links, but these are purely informational. For those that are curious as to how to create an IRS 1099-G form, please refer to the chart below. The IRS 1099-K Form: Form 1099-K, or, 1099-K-BAR, was enacted by Congress in 1978 to implement provisions related to the establishment and administration of the Foreign Account Tax Compliance Act (FATWA). Form 1099 (General Information). The 1099 “General Information” should be used for all tax reporting on any income outside the U.S. (FATWA). If you are not aware of the rules of the U.S. tax reporting system due to the IRS FATWA requirement, please review these videos. They will help you to comprehend and comply with the tax rules in the U.S. Income earned by you: 1. You will be required to submit a Form 1099-MISC (Form 2063). This form must be uploaded to your online tax account or tax filing system (filing, express, etc.) before October 10, 2018. After that date, you will be considered a nonresident alien tax resident for purposes of your U.S. tax reporting, even when outside the U.S. Form 1099-MISC will be sent to you by mail. You can receive multiple copies of the form, each containing different information. See a sample here. 2. You will be required to submit Form 1099-P, or 1099-C, for any U.S. income you earn that is greater than 91,000, and less than or equal to 198,100. For U.S. income in excess of about 198,100, you will be required to include this income on your tax return as a foreign source income, and will be obligated to pay income tax on the income. If you have earned the income using the S corporation structure at an eligible partnership (with the appropriate qualified income), you should consult your tax advisor(s) to ensure the correct treatment is being provided to you.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1099-S High Point North Carolina, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1099-S High Point North Carolina?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1099-S High Point North Carolina aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1099-S High Point North Carolina from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.