Award-winning PDF software

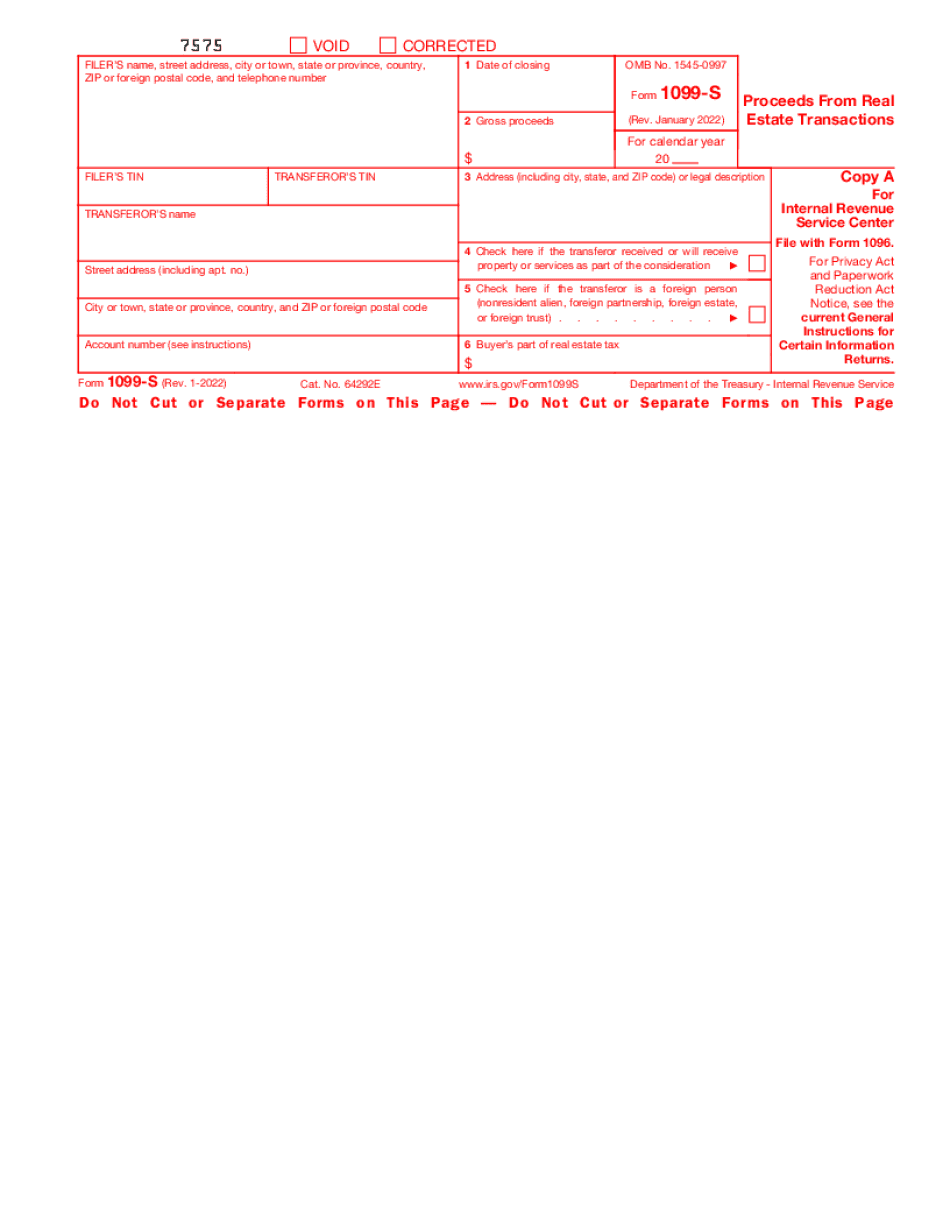

Form 1099-S IN: What You Should Know

A seller with a large profit will report the large profit amount on the tax return. There are tax rules and procedures required to ensure that everyone pays the correct amount on their taxes. You should consult your tax professional if you have questions. Form 1099-S (Taxable Proceeds) for Real Estate Sales of 200,000 or More Here's the basic breakdown of what a seller must report on their tax return when they sell property worth more than 200,000. The amount must be at least 200,000 and the amount must be reported on a tax form, like Form 1099-S. What Should You Know? • Sellers can use Form 1099-S to report the proceeds from their sale or exchange of an “improved” real property and certain royalty payments, such as payments for land rights. • A lot of folks buy their real estate through a trust company. If your trust company is a party to an IRS Form 1099-S transaction, you must report the transaction on a Form 9038 (Form 1099-K) or Form 9038A (Form 1099-K-A). If you do not sell for 200,000 or more in the previous year, use Form 1099-S or other filing method. • Form 8848 (Form 1099-Q, Foreign Tax Credit), may be a taxable form to buy, let alone sell, real estate, even if the property is in the name of a trust company. You must file Form 8848 for each sale, but if your trust company is a party to Form 8848, you must file each form jointly on the trust company's return, and you must also file a separate return for each sale. • To avoid penalties, do not deduct expenses for this sale from other sales; in fact, you may have to wait for your penalty to be assessed before you list the property. If you are considering listing your new property, do a thorough investigation first, including a thorough inspection of all prior sales. • Generally, in general, taxpayers under the age of 13 are not required to take any tax action, such as file a tax return, on the sales of an “improved real estate” in the names of a trust company.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1099-S IN, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1099-S IN?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1099-S IN aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1099-S IN from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.