Award-winning PDF software

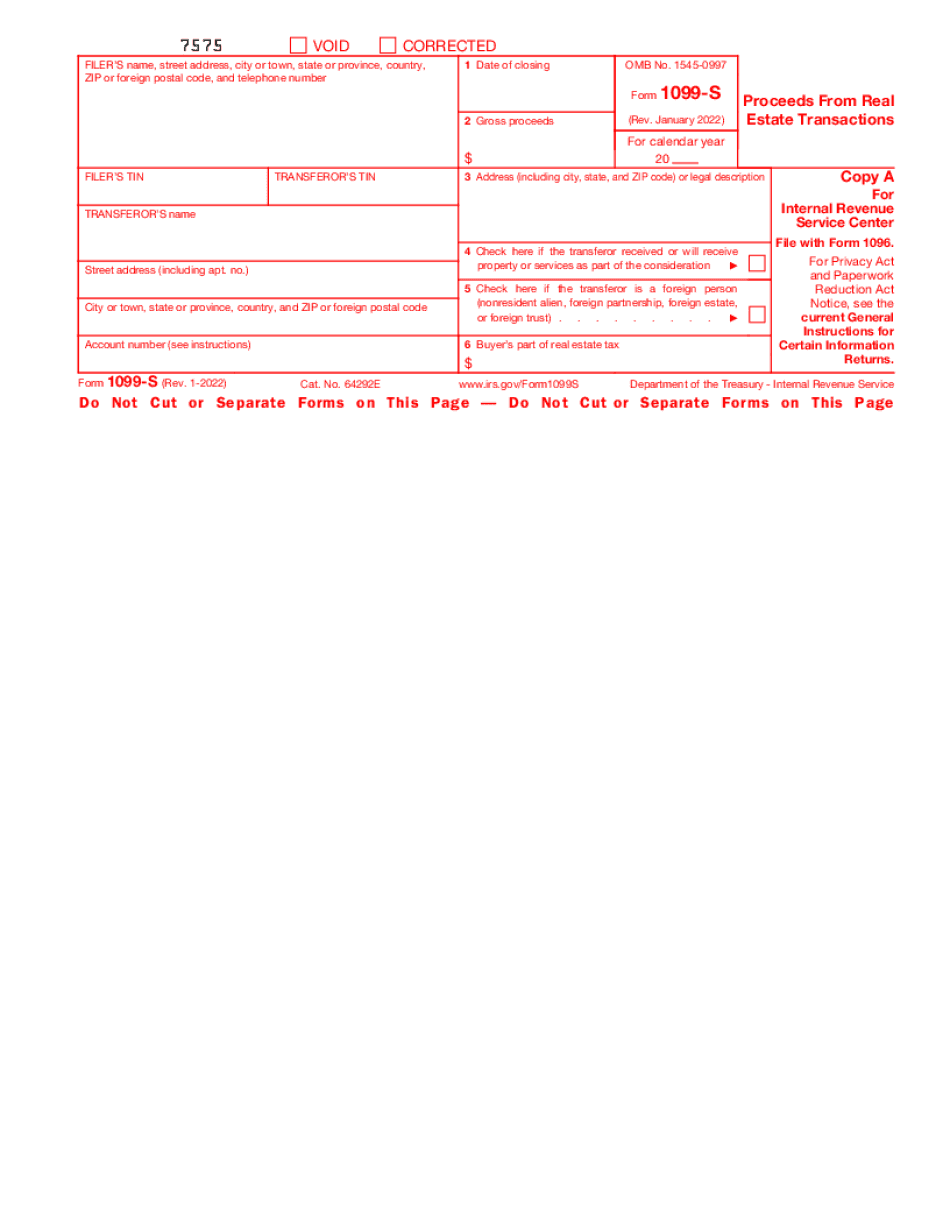

Form 1099-S for Hollywood Florida: What You Should Know

The form can be filed by the real estate broker, mortgage lender, or real estate agent. Form 1099-S — Tax Information for Sellers — P.O. Box The IRS requires that real estate sellers file Schedule OF tax returns on line 12. The tax form is for the sale of real estate and does not apply to any other transaction. Form 8296 — Foreign Income and Expense Reporting On Line 14 we have the code. The code is for an itemized list, you need to enter only the information that is necessary. If you want to enter the same list on your W9, you should include all the information. Form 1098 — Miscellaneous We all need to fill out a Form 1098 or 1099 — Miscellaneous if we are not filing for a foreign income tax. This is where there is a lot of information for a lot of information — it took us about five minutes to fill this out. File or Amend Federal Income Tax Return You must file or amend your federal income tax return if you owe any money to the government for the year. Here are the instructions: The form is due on the due date. If it is an extension, use line 13 of Form 1040, U.S. Income Tax Return (or Form 1040A) to figure how much more time to file from the deadline. If you have to file a joint return, line 12 of Form 1040A should already include your spouse on the form. If you owe any tax this year but want to postpone filing it until next year (or your due date) or do not want to pay this year's tax until the following year, use line 18 of Form 1040, U.S. Income Tax Return to figure how much more time to file from the deadline. If you pay this year's tax by the due date then you get a refund even if the return is delayed. If you do not pay the tax by any agreed-upon date or time, your refund will be based on the amount you owe then. What if I don't think I owe anything? If you have no reason to think that you are not owed any tax, check the date in box 15 where it says, “No reason — No refund”. If you have a lot of reason to think you owe something, call the IRS and tell them.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1099-S for Hollywood Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1099-S for Hollywood Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1099-S for Hollywood Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1099-S for Hollywood Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.