Award-winning PDF software

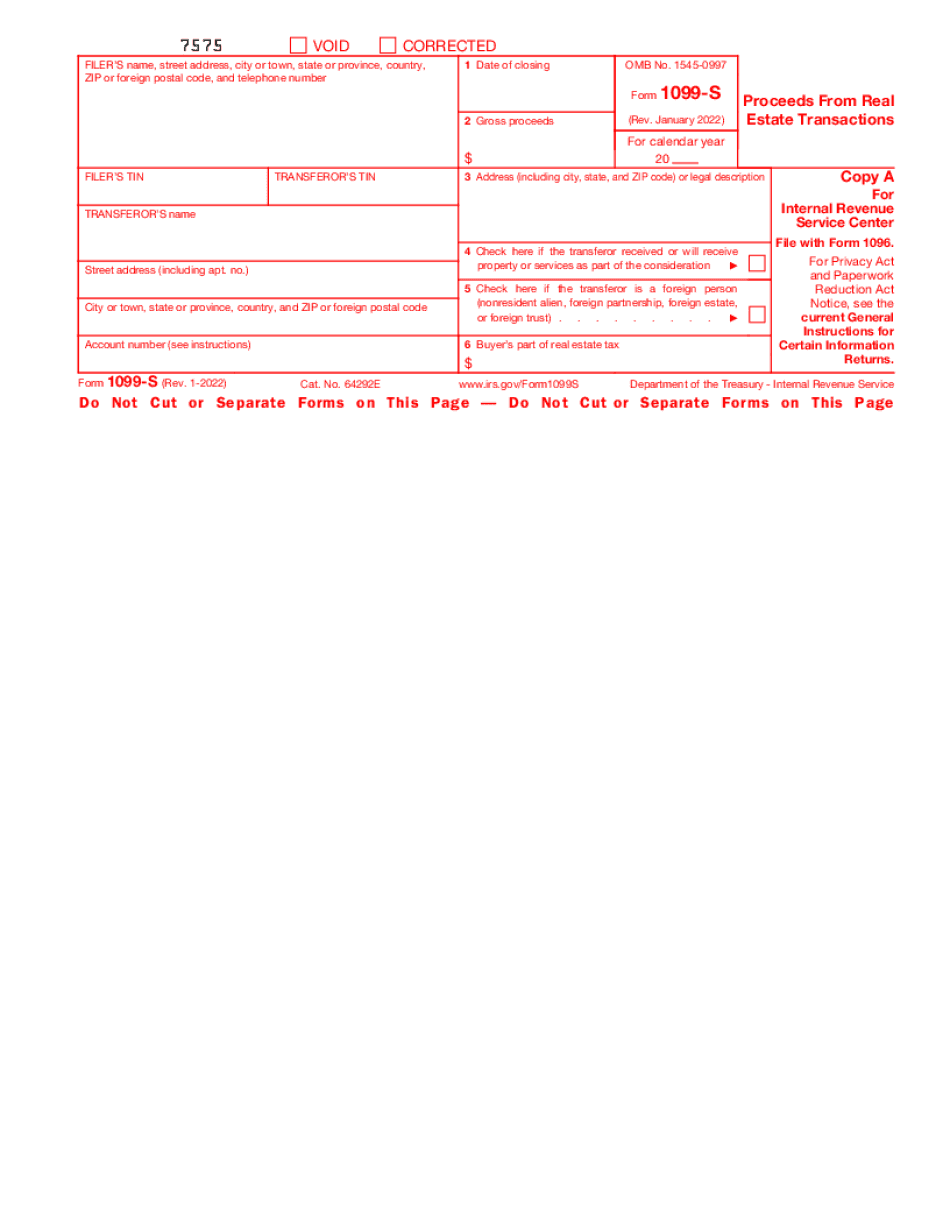

Form 1099-S online Fort Collins Colorado: What You Should Know

This can be done when your return is submitted on paper or online. Form 1099-F: Employer For-Hire Wage Payment All paychecks (including those from an employer of unknown employer) should include an IMPALA exclusion, even when an illegal alien is paid wages at the wages due to Colorado taxpayers' employees. For more information, visit the following link or go to the Colorado Department of Revenue. Forms — Income, Estate and Gift Forms — In-State & Out-of-State The following links have information and forms for Colorado on them. Form 1099-EZ: Employer-Provided Educational Assistance Use this form to report tuition and fees received from the University of Colorado, which is a public institution. Form 1099-G: Gross Income Tax Use this form to declare gifts, bequests, raffle winnings or any other amount of income earned while providing care to an individual who has a qualifying disability (other than “minor” or “physically challenged” status). Form 1099-T: Tips Use this form to report tips to your wait staff that are received while a customer is in your establishment. Please note that this form only applies to tips received from workers in restaurants and bars, and it may be misleading to report tips received from wait staff in a hotel. Form 2441: Foreign Tax Credit (For Businesses) Use this form to report income that was paid to foreign citizens or corporations in exchange for US services. Form 4789: Information about the Estate of a decedent Use this form to report the gross estate amount (generally the final value of the assets, the amount of assets that will not be distributed to your beneficiaries, etc.) and the value of financial interest in a deceased person, as well as any financial interests you already know about that were created by the decedent (such as an interest in a business that created your financial interest). If this information is not available, you can get it from the local Colorado state records office (listed below on IRS.gov). If you do not need to file this form, fill it out now (form 1120EZ or 1120S) and mail it to us.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1099-S online Fort Collins Colorado, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1099-S online Fort Collins Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1099-S online Fort Collins Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1099-S online Fort Collins Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.