Award-winning PDF software

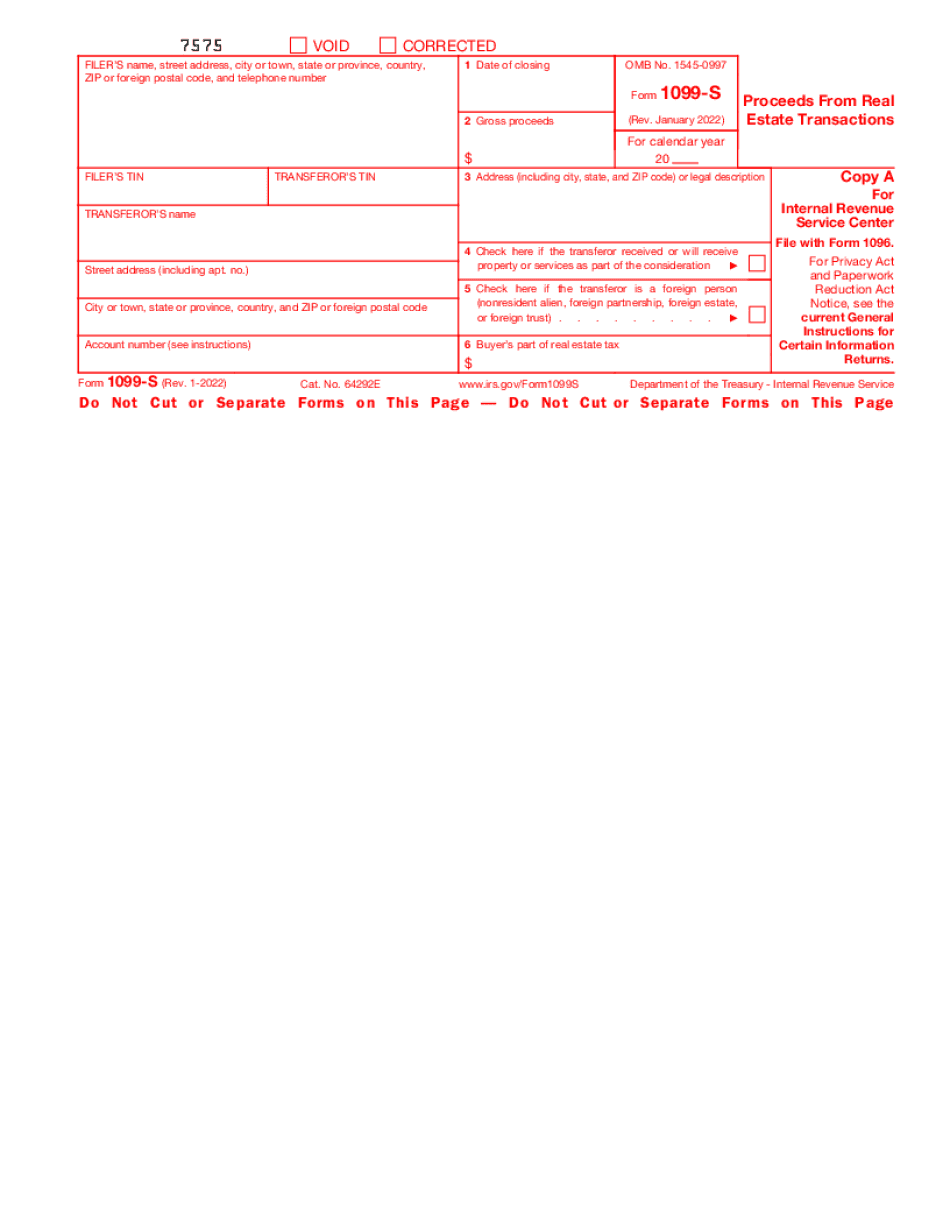

Ohio online Form 1099-S: What You Should Know

States including Ohio and Virginia. We provide easy-to-use payment options including a credit card, debit card by pre-authorized debit or direct bank deposit. We do not charge tax prep fees to process your state-filed federal state tax returns and will bill you if we have to. You only pay when we file. All we ask is the State Tax code or Ohio Taxpayer Identification Number (TIN) on the tax return. Please Note: The TIN is also available by entering your Filing ID on our secure site. Your online Ohio tax submission will be processed online within 24 hours. Submit a state tax return now using Tax1099.com. Please enter your TIN or Filing ID # in the state name field. When you have completed your transaction enter your return to the bottom. Payment Options For the first time, we are offering credit card, debit card and direct bank deposit methods of payment. You only pay when we file. You will receive a completed IRS tax return within 7 -10 working days after your state tax payment is received. Checking the status of a payment via direct bank deposit will not show a pending bank account balance. Payment is made by pre-authorized debit or debit card, via a pre-authorised debit or direct bank deposit, direct check or wire transfer. Payment can also be made online through the web based or secure site. All transactions are processed to the States using the Ohio filing system and payment is automatically credited to your checking account the same day. Federal Tax Filing Requirements The Form W9-G (Withholding) is required to pay Federal income tax with the withholding rate for the tax period you are filing. IRS Tax Forms and Manuals The following form is available through IRS.gov : Form W-2, Wage and Tax Statement. Other Form Instructions. You do not have a job but must report wages on your federal income tax. Pay no more than the minimum wage for each pay period. Ohio Income Tax — General Guidelines Ohio taxpayers have 4 choices for filing state income tax returns: We are not affiliated with or endorsed by the State Tax Commission of any State. Therefore, all forms referred to in this discussion are the copyrighted property of their respective copyright holders. All rights reserved. All forms may be reproduced for personal educational use as long as no profit is made and no copy can be used in a commercial publication.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Ohio online Form 1099-S, keep away from glitches and furnish it inside a timely method:

How to complete a Ohio online Form 1099-S?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Ohio online Form 1099-S aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Ohio online Form 1099-S from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.